When the deceased has left behind valuable assets, it can make the grieving process even more confusing and problematic.

Although in some quarters, preparing a will is still tabooed, many Jamaican have now gotten past that and into the habit of leaving behind a will - which in a nutshell, simply stipulates who is in charge, and who gets what is left of assets.

This leads us right to the title question. How do you probate a will in Jamaica?

By the way, a ‘Probate’ simply means to examine and prove that the will is prepared in accordance to the Wills Act, essentially establishing the validity of the will.

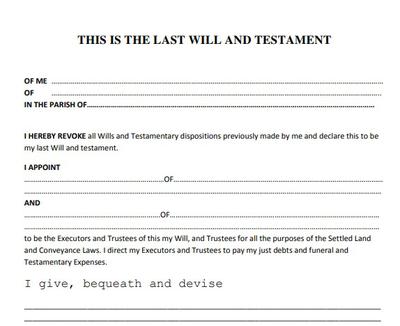

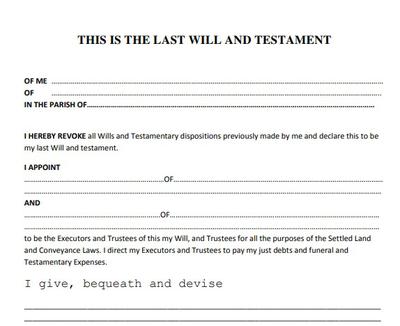

I've attached a simple copy of a blank will in Jamaica for your review here.

Now, it should be noted that probating a will can be a tiring and tedious process but it is important to fulfill the your loved one’s last wish.

Here are some guidelines and notes that will be sure to help to make the process smoother for you.

To assist with the process, such as drafting an application, the executor would obtain legal representation from an attorney. The executor will be given the original will.

The executor’s main duty is to collect and preserve the assets of the deceased. Therefore, documents such as: bank books or statements, titles to land and motor vehicles and share certificates, must be collected.

In some cases, the executor is entitled to executor’s commission of 6% of the value of the estate, however the testator can detail in the will that no executor’s commission be charged to the estate.

Nevertheless, the executor would be reimbursed for any provable expenses he incurred while performing his/her duties.

Important Note:

If the testator fails to mention an executor(s) in the will, then the testator’s next of kin can apply to becoming the administrator for the estate.

The lawyer will then draft “The Oath of Executor”, which is a document that outlines basic information of the deceased and the declaration that the executor will carry out his duties effectively.

He will also draft the Grant of Probate. In certain circumstances other documents will be needed such as:

If the value of the estate is more than $1.5 million, then application is made to the Supreme Court. On the other hand, if the estate does not exceed $1.5 million then the application is filed at the Resident Magistrate’s Court.

Additionally, the executor will present a Revenue Affidavit to the Stamp Duty and Administration Tax Division of Tax Administration Jamaica (TAJ).

The Revenue Affidavit indicates the estate’s assets and their value. The TAJ uses this information to determine the transfer tax (also known as estate duty) and to determine if transfer tax is due in the estate.

For instance, if you lived in the house the deceased willed to you, then you will not pay transfer tax because in essence, it is your home. However, if you didn’t live in the house, you would pay transfer tax. Get the drift?

This advertisement is necessary to determine whether or not the testator died indebted to anybody. The creditor, who claims that the deceased owed him/ her money, can file against the estate so long as they can provide real proof.

Claims are to be made within six weeks after publication of the advertisement.

When all the valid claims have been covered, the remaining assets can now be distributed to their beneficiaries.

Remember when matters such as these arises, always seek the services of a lawyer. They will be able to properly guide you.

Hope this was of some help!