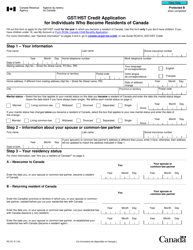

Form RC151 Gst / Hst Credit Application for Individuals Who Become Residents of Canada - Canada

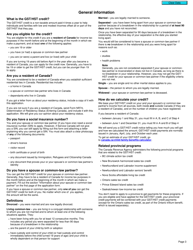

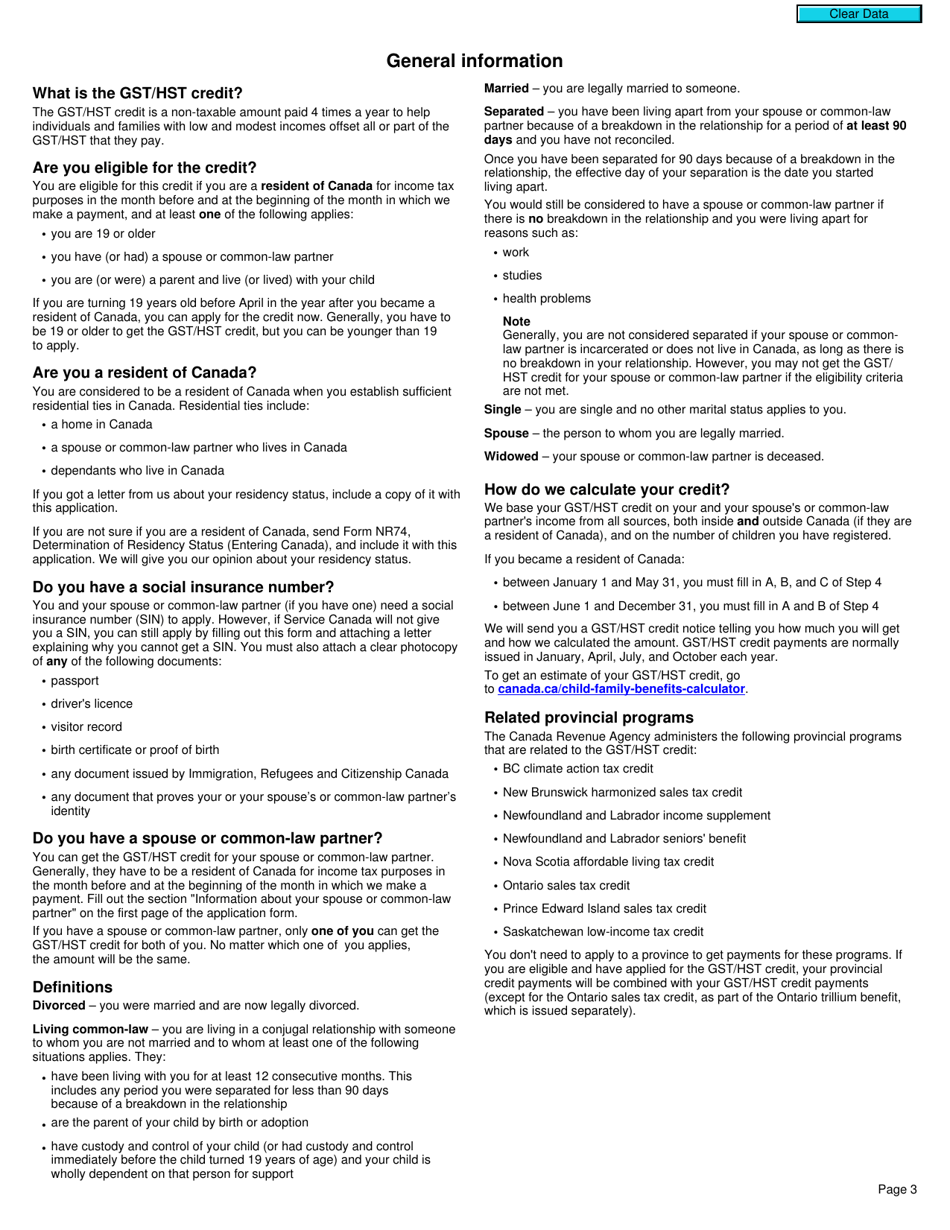

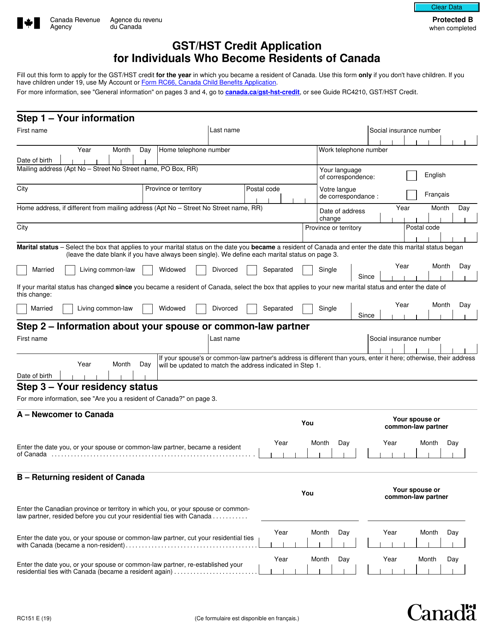

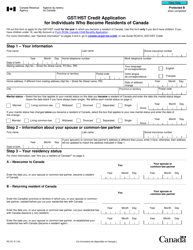

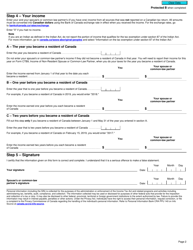

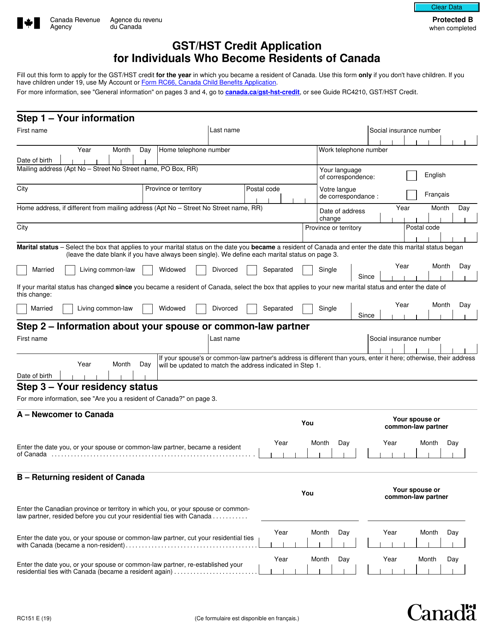

Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada , is the document you will need to complete when you apply for residency standing in Canada. You also have the option to have this monetary credit sent via direct deposit online through the government's website. This form is issued by the Canadian Revenue Agency (CRA) and was last updated January 1, 2019 . A fillable RC151 Form is available for download through the link below.

- Canada GST Form;

- Canada HST Form.

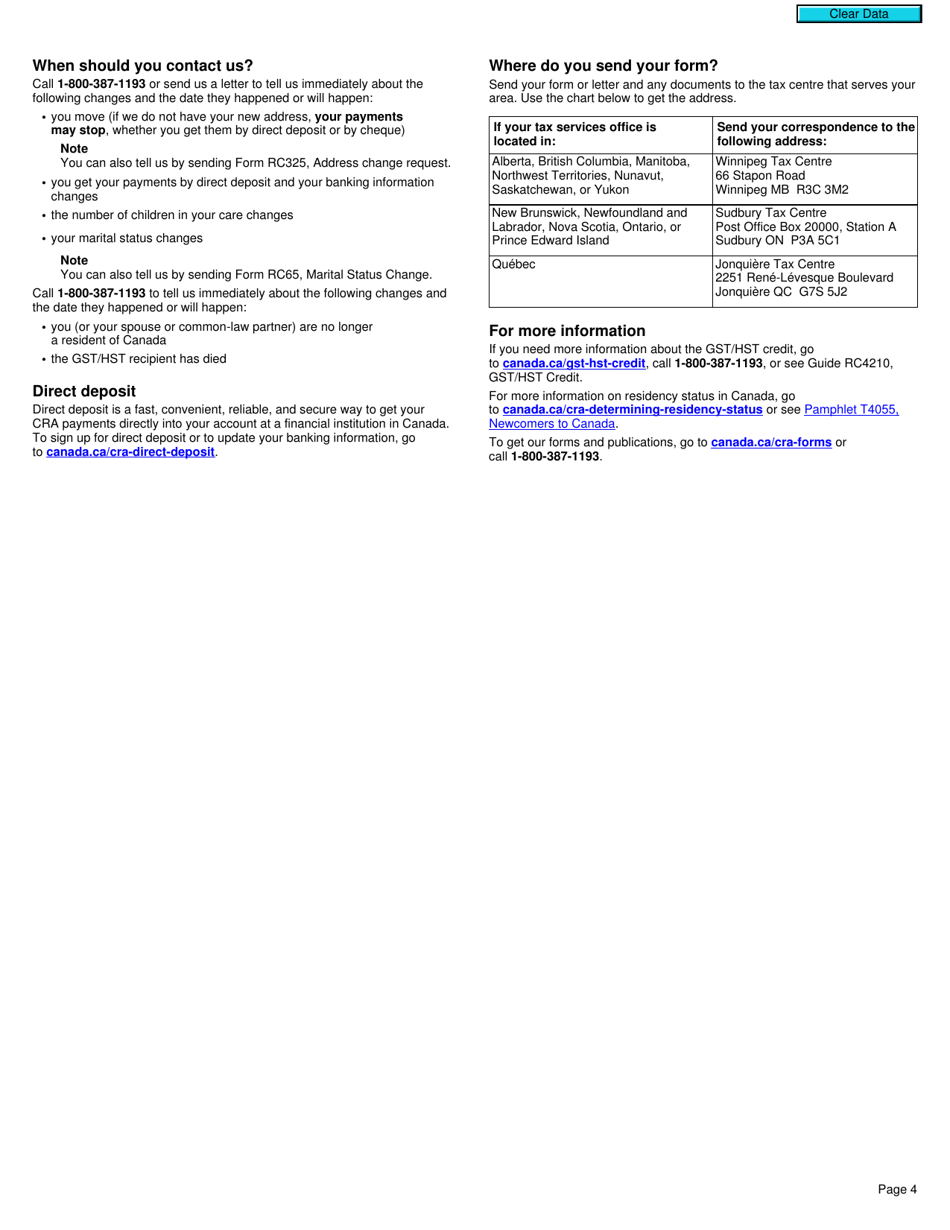

This form is completed within the first twelve months a person qualifies as a resident of Canada, allowing you to formally take part in the GST/HST reimbursement system. Residents then have the ability to take advantage of tax credits for this reimbursement system should their earnings meet the threshold for lower livelihood tiers. The regional postal addresses for this form are listed near the bottom of Form RC151.

ADVERTISEMENT

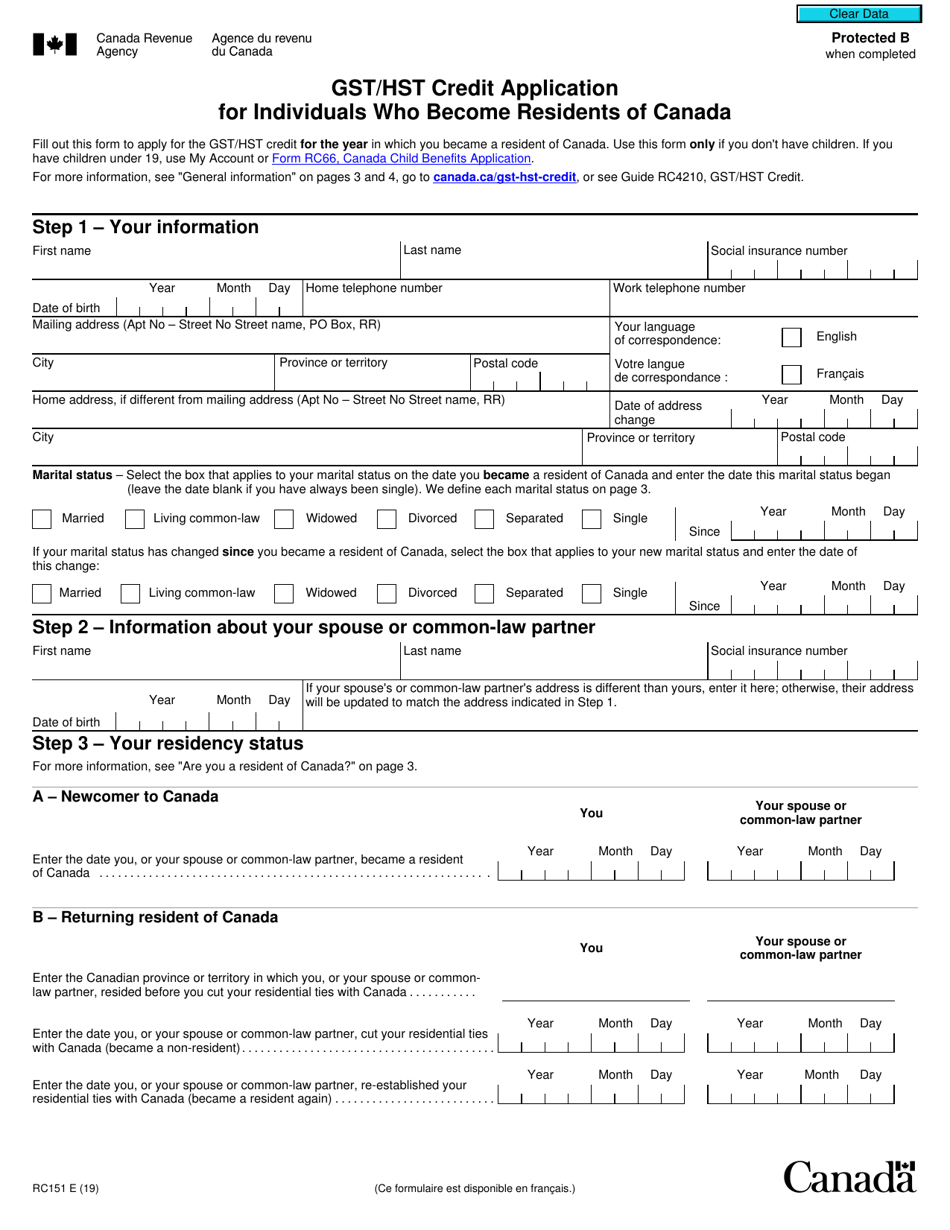

How to Fill Out RC151 Form?

To complete the Canada GST Form, you be asked to provide the following information:

- Part A will ask you to include your basic identification. This includes your full name, Social Insurance Number, birthdate, home and work phone numbers, and full mailing and home address (if these addresses are different). Specify your language preference (either English or French), the most recent change of address and the date it occurred, and your marital and residential status.

- Part B will ask you about your spouse. Specify their full name, birth date, and social insurance number. If you're in a long-term relationship with another individual but are not married, you will have the option to classify the relationship as a common-law marriage.

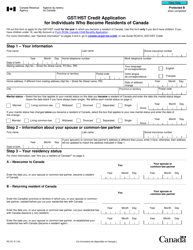

- Part C will request information about the residency standing of both you and your partner. It will also ask if you are considered new residents of Canada or are previous citizens returning to Canada, and will ask for the dates corresponding to these events. The final questions in this section will help you figure out if you meet the legal requirements as a resident of Canada and ways to check with government officials if you are unsure of your residency standing. As part of the final section, you will also locate explanations about the requirements for obtaining a social insurance number should be in need of one and additional financial incentives each province has available to its citizens.

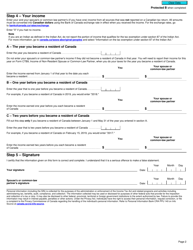

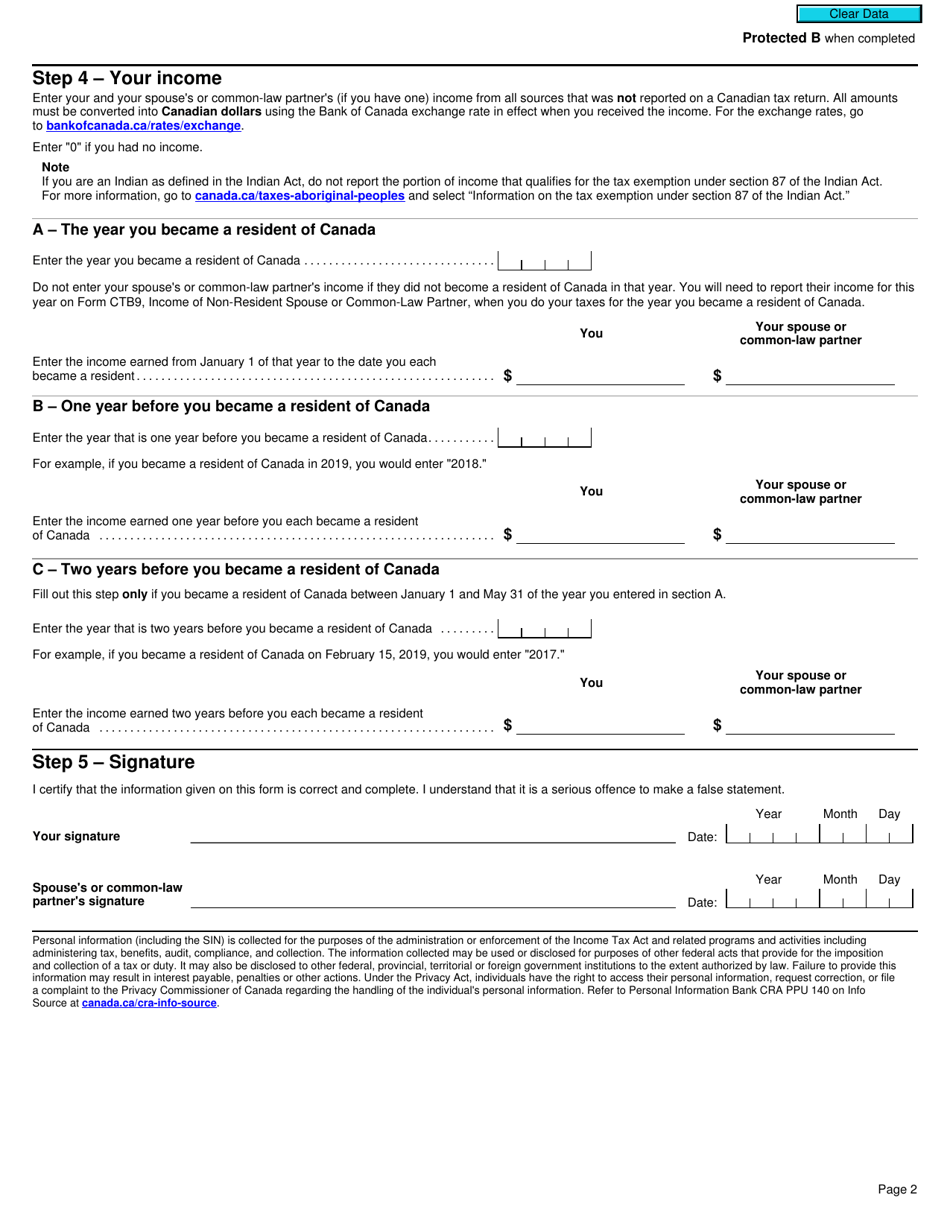

- Part D requests information concerning your household's yearly earnings. The form will ask only for your and your spouse's income (no additional household members' income will be necessary) for the year you became a resident in addition to the two years prior to this date.

- Part E contains the final certification section where you and your spouse will sign and date the form.

Download Form RC151 Gst / Hst Credit Application for Individuals Who Become Residents of Canada - Canada

4.8 of 5 ( 8 votes )

1

2

3

4

Prev 1 2 3 4 Next

ADVERTISEMENT

Linked Topics

Canadian Revenue Agency Canadian Federal Legal Forms Canada Legal Forms

Related Documents

- Form RC66 Canada Child Benefits Application Includes Federal, Provincial, and Territorial Programs - Canada

- Form RC66 Canada Child Benefits Application (Includes Federal, Provincial, and Territorial Programs) - Large Print - Canada

- Form RC66-1 Additional Children for the Canada Child Benefits Application - Canada

- Form RC66SCH Status in Canada and Income Information for the Canada Child Benefits Application - Canada

- Form GST189 General Application for Gst/Hst Rebates - Canada

- Form GST20 Election for Gst/Hst Reporting Period - Canada

- Form GST190A Schedule A Gst/Hst New Housing Rebate - Canada

- Form GST66 Application for Gst/Hst Public Service Bodies' Rebate and Gst Self-government Refund - Canada

- Form GST498 Gst/Hst Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units - Canada

- Form GST115 Gst/Hst Rebate Application for Tour Packages - Canada

- Form GST288 Supplement to Forms Gst189 and Gst498 - Canada

- Form GST370 Employee and Partner Gst/Hst Rebate Application - Canada

- Form GST159 Notice of Objection (Gst/Hst) - Canada

- Form GST190 Gst/Hst New Housing Rebate Application for Houses Purchased From a Builder - Canada

- Form GST190 Gst/Hst New Housing Rebate Application for Houses Purchased From a Builder - Large Print - Canada

- Form GST191 Gst/Hst New Housing Rebate Application for Owner-Built Houses - Canada

- Form GST20-1 Notice of Revocation of an Election for Gst/Hst Reporting Period by a Listed Financial Institution - Canada

- Form GST524 Gst/Hst New Residential Rental Property Rebate Application - Canada

- Form GST518 Gst/Hst Specially Equipped Motor Vehicle Rebate Application - Canada

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.